This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: What has been the impact of the Coronavirus/COVID-19 on the real estate market?

Answer: In this week’s review of how the COVID-19 pandemic is impacting real estate, we’ll take a look at how Arlingtonians think Coronavirus will change their personal finances, how the Arlington market performed over the last seven days, and how the virus is changing the mortgage industry.

Arlingtonians Still Confident

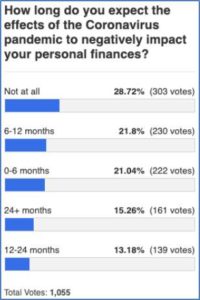

Thank you to everybody who participated in the poll last week, we collected some really valuable information about how Arlingtonians think the virus will impact their personal finances.

Out of 1,055 respondents, 50% feel that their personal finances will either not be negatively impacted or that the impact won’t last more than six months. Over 70% of respondents don’t expect the negative effects to last more than 12 months.

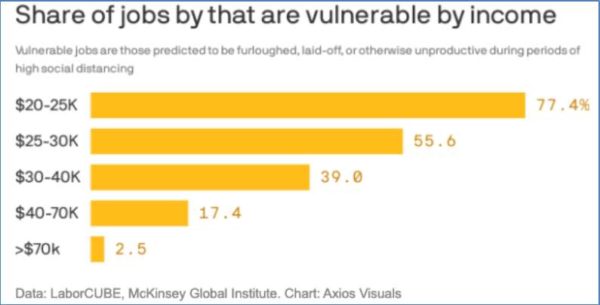

These results reflect a strong local consumer (buyer) confidence and would suggest that local buyers still have enough confidence in their finances/income to make a long-term investment, like buying a home. When you consider the recent McKinsey study (below) on the most vulnerable jobs, you can see why Arlingtonians, many of whom make over $70k/year, remain confident in the face of a global economic crisis. Income/job security is likely the most important consideration for people determining what the negative impact of COVID-19 will be on their personal finances.

Arlington Market Update

New inventory tanked over the past week and we saw the largest week-to-week drop in the number of properties that went under contract. It’s hard to say for sure whether the decline in contract activity is demand-based on a result of less inventory, but it’s likely a combination of the two.

With very little new inventory coming to market and the Coming Soon pipeline drying up, total inventory is dropping quickly, which should keep home values relatively protected, despite declining demand.

Past Seven Days (Arlington)

Seven Days Prior

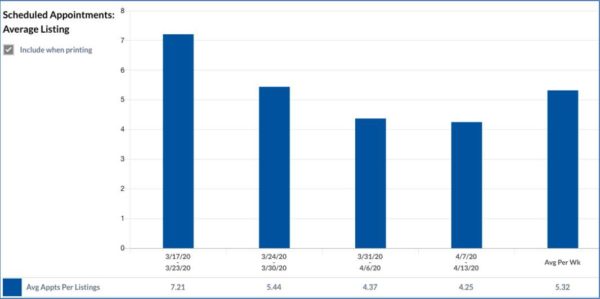

Showing activity is down significantly compared to a normal spring market, but it seems to be stabilizing at an average of 4-5 scheduled showings per week on properties listed in Arlington. I think that significant increases/decreases in showing activity will be a leading indicator of how the market feels about the risk of Coronavirus to public health and the local economy.

Major Changes To Mortgages

The mortgage industry has experienced rapid and impactful changes over the last month that will surely change demand for months or years to come. I checked in with Jake Ryon of First Home Mortgage ([email protected]) on the top three ways Coronavirus is impacting the mortgage business.

Elimination of Products/Tightening of Requirements

Mortgage products are designed around a bank’s ability to accurately predict a borrower’s ability to repay their loan, so as economic uncertainty rises, a bank’s ability to forecast borrower risk decreases and banks become more risk averse.

As a result many loan products not backed by the Federal Government are being eliminated including loans like sub-20% down payment jumbo loans without Mortgage Insurance (a popular mortgage product locally), Non-Qualified Mortgages (borrowers with lower credit scores or high debt-to-income ratios), and mortgages for investment properties.

I’ve also heard that Second Trust loans, a popular product that allows you to purchase your next home without making it contingent on the sale of your current home, may be up next for elimination.

In cases where products aren’t being eliminated, some products have tighter borrowing standards like higher reserves or credit scores. I suspect that changes to jumbo loan programs and a potential elimination of Second Trust loans will have a material impact on the D.C. Metro’s ~$1M-$1.5M market.

If you’re currently searching for a home, you should regularly check-in with your Loan Officer, especially before making an offer, to confirm that the loan product you plan to use still exists and the requirements haven’t changed.

Interest Rate Volatility

Interest rates hit all-time lows in the beginning of March, but a week later spiked in response to an overwhelming rush of refinances. The first half of March was one of the most volatile periods for mortgage rates ever, including the most volatile day ever. Since the Fed stepped in with liquidity, rates have stabilized, but are still relatively volatile.

Rate volatility is generally bad for demand because buyers take comfort in certainty. Here’s a chart showing rate movement over the last six months to highlight how crazy the last six weeks have been:

Increased Loan Forbearance

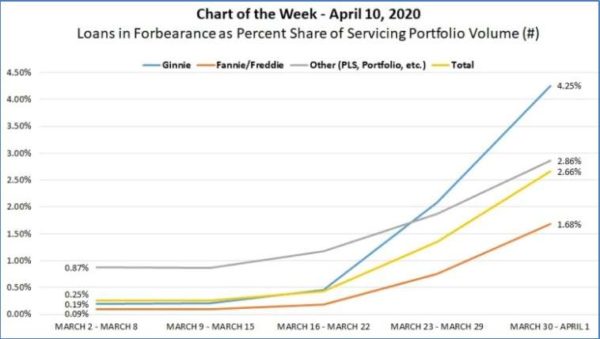

Loan forbearance (temporary pause on mortgage payments) is skyrocketing in the US, and will likely be another exponential chart to watch over the next few weeks/months. Borrowers pay a Servicer (lender) and the Servicer pays investors, who are guaranteed to receive their payments from Servicers even if borrowers stop paying. This has led to a massive liquidity crunch for many lenders and put their businesses in jeopardy of failing, despite efforts by the Government to relieve the pressure.

If you’d like to discuss buying or selling strategies in this market, don’t hesitate to reach out to me at [email protected].

Be smart, be careful, be strategic. And stay home!

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local real estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington D.C., and Maryland with RLAH Real Estate, 4040 N. Fairfax Dr. #10C Arlington, VA 22203, (703) 390-9460.

"impact" - Google News

April 15, 2020 at 12:15AM

https://ift.tt/2XHCXPQ

Ask Eli: Impact of Coronavirus on the Real Estate Market, Part 6 - ARLnow

"impact" - Google News

https://ift.tt/2RIFll8

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Ask Eli: Impact of Coronavirus on the Real Estate Market, Part 6 - ARLnow"

Post a Comment