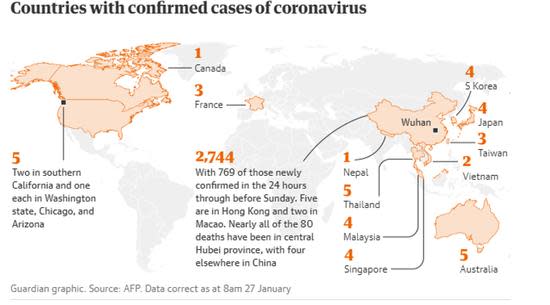

The positive momentum of 2019 carried into 2020, and markets were continuing to soar on the back of softening trade tensions between the U.S. and China, earnings beats by banks and the expectations for the American economy to grow in the next couple of years. When nothing seemed to challenge this run, a novel coronavirus broke out in Wuhan, China, changing investment sentiment overnight. According to the latest data, the virus has now spread to a few other countries, including the United States.

- Warning! GuruFocus has detected 3 Warning Signs with BABA. Click here to check it out.

- BABA 30-Year Financial Data

- The intrinsic value of BABA

- Peter Lynch Chart of BABA

Source: The Guardian.

The same way many geopolitical and macroeconomic events have an impact on the performance of equity markets, empirical evidence suggests there's a negative correlation between a breakout of a virus and stock prices. In this analysis, we will observe the impact of the coronavirus and identify potential investment opportunities.

Learning from history

Since 1970, there have been several epidemics that impacted global markets. In most of these instances, global markets have reacted negatively, primarily because of fear that global economic growth will reach a standstill due to the uncertainty surrounding the spreading of the virus. This historic fear has now returned to markets.

Charles Schwab strategist Jeffrey Kleintop wrote:

"There are concerns that the coronavirus may spread quickly within and beyond China, causing economic and market damage. This is particularly a concern as travel ahead of the Lunar New Year is getting underway."

If there's anything to learn from past epidemics, it's that the pessimistic sentiment will be short-lived. As illustrated in the below graph, in the three months following an outbreak, the performance of global markets has been disappointing. However, things look completely different when the timeline expands to six months.

Source: Marketwatch/Factset.

While investors should not ignore the economic impact of the coronavirus outbreak, it's important to stay with the original big picture as this epidemic will likely not lead to a major change for growth prospects.

Sectors with the biggest impact

The travel industry is at the core of the virus outbreak. The Lunar New Year is one of the biggest events in the world as consumer spending on travel during the celebration makes this a very important period for the industry.

Source: Statista.

Considering these numbers, it doesn't come as a surprise that travel stocks are taking a hit. Over the last five trading days, the S&P 500 Airlines Index has plummeted due to the developing pessimism surrounding the industry in Asia.

Source: Google Finance.

IHS Markit economist Rajiv Biswas wrote last Friday:

"The 2003 SARS crisis created a severe negative impact on GDP growth for the Chinese economy and also hit the economies of a number of Southeast Asian nations, including Malaysia, Singapore, and Vietnam. However, other economies are also vulnerable, with the SARS epidemic having also had a negative impact on the economies of Canada and Australia. Since the 2003 SARS crisis, China's international tourism has boomed, so the risks of a global SARS-like virus epidemic spreading globally have become even more severe."

Crude oil has also taken a hit as economists are assessing the impact of the virus on the economic growth of China and the decline in demand for air travel in this region.

Source: GuruFocus

The declining oil prices will push shares of energy companies lower as well, which is, once again, likely to be short-lived.

Volatility creates opportunities

The loss of human lives is tragic. Authorities in China have already taken tremendous measures to avoid the virus from spreading to different parts of the country. There is hope that the outbreak will be temporary. The impact on markets, in any case, will most likely be short-lived based on historical evidence.

In the short term, there could be a severe impact on consumption in China and some parts of the world, leading to lower-than-expected economic growth. This is bad news for investors, but empirical evidence points out that the long-term impact for global economic growth will be negligible. Therefore, looking at the epidemic in isolation will not provide a robust view of what to expect from markets in 2020 and beyond.

Below is an excerpt from a report released by Fidelity, which confirms this perspective.

"We cannot draw any fixed conclusions about the effects of pandemics upon stock market performance. Equity markets react unpredictably to the unknown: nevertheless, such events should not be examined in isolation, but viewed in common with other prevailing market conditions."

The falling airline stocks present a contrarian opportunity for investors as the global economy is projected to remain positive over the next couple of years. Travel from Asia is expected to continue its dominant position on a global scale in 2020 as well. According to the World Travel Monitor, outbound travel from Asia rose by 6% in 2019 and remained as the leading contributor to the growth of the industry. Even though there will be a slowdown in 2020 due to the outbreak of the coronavirus, travel spending will likely pick up over the remainder of the year as the geopolitical outlook is more favorable for economic growth than it was prior to the signing of the trade deal with the United States.

Investors should consider investing in e-commerce companies in the Asian region as well. In a news article dated Jan. 23, Yicai Global claimed that Taobao, an online shopping platform operated by Alibaba Group Holdings Ltd. (NYSE:BABA), has sold more than 80 million pieces of protective face masks within just two days. Chinese residents are likely to stay indoors while the government authorities address the outbreak of the virus, which creates opportunities for online retailers such as JD.com Inc. (NASDAQ:JD). It is well known that the company was one of the first to identify the opportunity to go fully online during the SARS outbreak in 2003.

The higher number of hours consumers will spend indoors will inevitably lead to an increase in the time allocated to entertainment purposes. Often regarded as the Chinese equivalent of Netflix (NASDAQ:NFLX), iQIYI Inc. (NASDAQ:IQ) will likely see a huge spike in viewership, which can be expected to translate into higher earnings for the first quarter of this year.

Emerging markets are trading at cheaper multiples than their U.S. peers as well, and this might be a good time to load up on Chinese and other Asian stocks as a recovery is likely to occur sooner than expected. Investing in the iShares MSCI China ETF (NASDAQ:MCHI) will give meaningful exposure to this region once the recovery begins.

Takeaway

People around the world are monitoring the situation in China in hopes that the epidemic will be put to an end as soon as possible. Maintaining composure and remaining neutral to external developments is a key ingredient to becoming successful at equity market investing. There is fear in the markets, which makes it a good time to bet on the ever-strengthening Chinese economy and the travel and energy sectors.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

- Ray Dalio and Warren Buffett's Contrasting Opinions on Cash

- A New Stock Pick of Warren Buffett's for Growth Investors

- Apple Is Overvalued, and Rupal Bhansali Thinks It's Time to Short

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

- Warning! GuruFocus has detected 3 Warning Signs with BABA. Click here to check it out.

- BABA 30-Year Financial Data

- The intrinsic value of BABA

- Peter Lynch Chart of BABA

"impact" - Google News

January 28, 2020 at 05:32AM

https://ift.tt/37vLYO8

Coronavirus and Its Impact on Markets - Yahoo Finance

"impact" - Google News

https://ift.tt/2RIFll8

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Coronavirus and Its Impact on Markets - Yahoo Finance"

Post a Comment