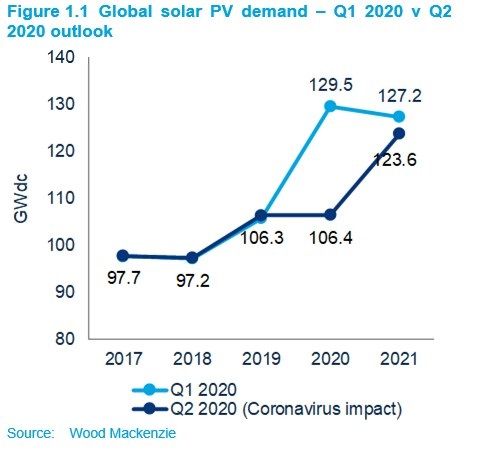

Wood Mackenzie slashed more than 20 gigawatts off its forecast for global solar deployments in 2020, as the impact of the coronavirus pandemic comes into sharper focus.

Construction is slowing, tenders are postponed and, for earlier stage projects, there are question marks around financing. As a result, WoodMac has slashed its forecast deployment by 18 percent, from 129.5 gigawatts to 106.4 gigawatts.

“Auctions are being delayed, PPA negotiations halted and permitting is slowing down,” Tom Heggarty, principal analyst for solar at Wood Mackenzie, said in a statement. “Weak power prices and collapsing FX rates are severely damaging the economics of new investments across a wide range of countries. Projects that were slated for 2021 will be tougher to bring to market on time, if they make it at all,” he said.

WoodMac's forecast for next year has been reduced 3 percent, from 127.2 gigawatts to 123.6 gigawatts.

“Although we expect a strong economic recovery next year, projects that should be delivered in 2021 are being developed and financed today. When the recession hits, not all activity will go ahead as planned,” he warned. A chunk of the coronavirus impact on next year’s deployment will be offset by projects originally scheduled for this year being shunted into 2021.

Delayed projects pushed into 2021 will cover up some of the losses then. (Credit: Wood Mackenzie)

Recession and response

The overriding risk for solar is the anticipated global recession. Wood Mackenzie assumes global GDP will shrink by 2 percent this year. The U.S. experienced a drop of 2.5 percent in 2008 during the Great Recession.

Residential and commercial sized installs are expected to be hit particularly badly as discretionary spending is cut.

“One risk to the upside, however, will be the reaction of policymakers. The stimulus taps have already been turned on, and no doubt there’ll be more to come as the immediate challenges posed by coronavirus fade and attention turns to the recovery,” said Heggarty. “If — and it’s a big ‘if’ — post-coronavirus spending is directed towards decarbonization efforts, solar PV could stand to benefit. That’s something we’ll be watching closely as we move through 2020.”

The European Union has already stressed that any stimulus must be aligned to its broader objectives, including the green transition. The next seven-year budget has yet to be agreed and any progress made thus far was done so in the absence of any COVID-19 considerations.

The U.S. did not include any provisions for renewables in its own stimulus packages released thus far. There are calls for the sunsetting solar investment tax credit (ITC) to be extended beyond the end of the year.

A low like no other

Solar is well used to cycles of boom and bust. Module prices were held artificially high in many markets last decade of transcontinental trade wars between China, the U.S., the EU and latterly India took grip. China’s dominant position upstream and downstream has meant fluctuations in its domestic deployments have had outsize consequences elsewhere. Cuts — especially retroactive cuts — to subsidy support programs have sent markets into a tailspin.

But coronavirus and the coming recession are something else.

“The difference here," Heggarty told GTM, "is that it impacts the entire global market at the same time. Everything that we have seen affecting the PV market in the past has in some way been localized. Not the entire market and across all sectors. This is a pretty unique set of circumstances."

Ultimately, the global solar market looks well positioned to ride out even this storm. Around 60 percent of the supply chain is concentrated in China, and early signs suggest the country has gotten over the worst. Heggarty does not foresee any major supply chain issues beyond localized logistics bottlenecks.

“There will be modules available. There will be inverters available. That won't be a problem on a global basis,” he said.

Meanwhile, the trend for decarbonization is going nowhere and solar is unlikely to be knocked off its cost curve.

“Solar is pretty quick to develop and construct. So once we start to see restrictions lifted, the industry should, theoretically, be in a good place to bounce back quite quickly,” said Heggarty.

"impact" - Google News

April 10, 2020 at 03:52AM

https://ift.tt/3e7zmk1

Coronavirus Impact Cuts 23GW From WoodMac’s 2020 Global Solar Outlook - Greentech Media News

"impact" - Google News

https://ift.tt/2RIFll8

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Coronavirus Impact Cuts 23GW From WoodMac’s 2020 Global Solar Outlook - Greentech Media News"

Post a Comment