Insured losses from Hurricane Sally could reach as much as $3 billion, according to catastrophe modelers, but ratings agency Moody’s expects a moderate impact on property & casualty insurers and reinsurers.

“Because Sally appears to be primarily a flood event, we expect that the National Flood Insurance Program (NFIP) …will absorb significant losses because standard property and casualty (P&C) homeowners policies do not include flood damage,” Moody’s said in a Sept. 18 circular to investors.

Moody’s analysts predict that P&C (re)insurers will face losses on commercial and some residential properties, though the full impact will take weeks to tally.

Karen Clark & Co. pinned insured losses to onshore properties from the Category 2 storm at around $2 billion, while AIR Worldwide estimates that losses to onshore property resulting from Hurricane Sally’s winds, storm surge, and inland flood will range from $1 billion to $3 billion, with wind representing the majority of the losses.

KCC said its estimates were based on the KCC high-resolution US Hurricane Reference Model and include the privately insured wind and storm surge damage to residential, commercial, and industrial properties and automobiles. The estimate does not include NFIP losses, losses to offshore assets, or any potential impacts on losses due to COVID-19.

AIR Worldwide included losses to onshore residential, commercial, and industrial properties and automobiles for their building, contents, and time element coverage in its estimates.

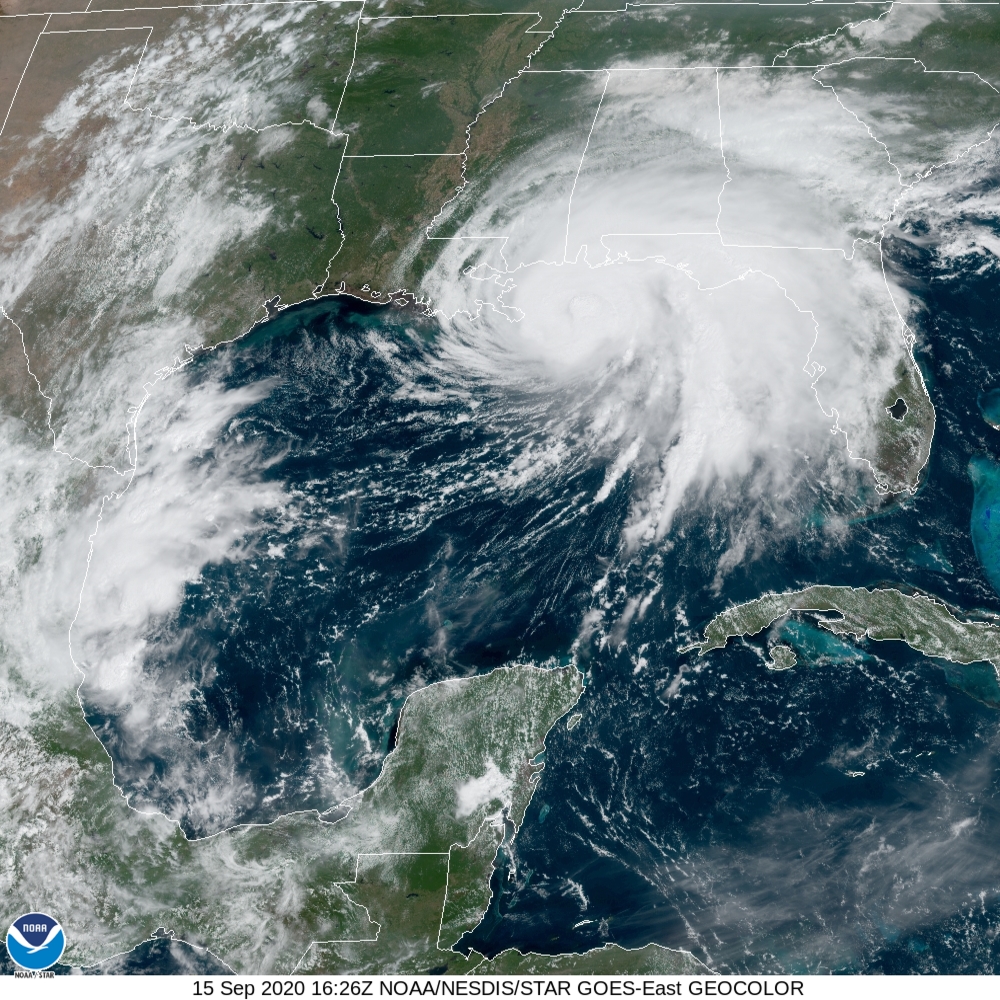

Hurricane Sally made landfall near Orange Beach, Ala., on Sept. 16, with maximum sustained wind speeds of 105 mph. KCC noted Sally was the first hurricane to make landfall in Alabama since 2004’s Ivan, which occurred 16 years earlier to the day.

The storm began to intensify as it moved inland toward the Florida Panhandle with winds of 80 mph, then diminished to a tropical storm.

AIR Worldwide reported storm surge of around 6 to 7 feet in coastal communities of Baldwin County, Alabama, and Escambia County, Florida (including Pensacola), and rainfall of up to 30 inches in Orange Beach and 24.8 inches in downtown Pensacola. Heavy rainfall was largely confined to a relatively smaller area covering the Florida Panhandle west of Tallahassee and southeastern Alabama.

According to AIR, although wind speeds diminished rapidly after landfall, Sally buffeted cities and towns for hours as it moved north-northeast across Alabama at speeds as slow as 2 mph. Coastal areas between Mobile, Ala., and Pensacola, Fla., lingered in the northern eyewall for hours. Tropical storm-force winds continued throughout the day across southern Alabama and the western Florida Panhandle.

KCC noted severe wind damage was limited to areas near the coast that experienced the highest wind speeds. Isolated instances of structural damage occurred, including damage to roofs and walls. Lower levels of damage, such as to roof covering and siding, were more widespread. Over 500,000 residents were left without power as severe winds brought down power lines in parts of Florida and Alabama.

Significant storm surge flooding in downtown Pensacola affected both residential and commercial buildings. A portion of the newly constructed Pensacola Bay Bridge was destroyed, and automobiles in the area also sustained damage.

Heavy storm surge flooding impacted coastal Alabama where water submerged residential and commercial buildings in Gulf Shores and deposited numerous boats and vehicles around Orange Beach. Multiple bridges in both cities experienced damage.

Sally could end up being a costly storm in terms of flood losses, Moody’s noted, but said that unlike 2017’s Hurricane Harvey, a Category 4 storm that caused widespread flood damage in Houston and Southern Texas, Sally struck in less commercially dense areas and will be much less costly for commercial insurers than Harvey.

However, because flood damage is not typically covered by homeowners policies, insurers could see disputes in cases where it is not immediately clear if the damage was caused by wind versus flood.

“Disputes increase and prolong the cost of the claims settlement process and may lead to lawsuits and/or regulatory intervention,” Moody’s stated.

Insurers also likely face claims on private passenger and commercial vehicles, watercraft and other insured assets, Moody’s said, adding “flood-related auto claims are almost always total losses.”

The primary insurers in Alabama likely to be affected based on their market share include State Farm Mutual Automobile Insurance Co., Alfa Mutual Co. and Allstate on the homeowners side and CNA, Travelers and Liberty Mutual Group for the commercial property market.

“Given their careful monitoring of exposures, geographic diversification, high quality reinsurance protection and strong capital bases, we believe these large national carriers are well capitalized to withstand hurricane events,” Moody’s said. “Regional insurers face greater effects because of their geographic concentrations.”

Commercial property insurers could see flood losses, and Moody’s expects the coronavirus and related economic downturn might complicate business interruption claims and heighten the number of disputes.

“Some interruption claims might reflect a combination of hurricane and coronavirus effects, with coverages depending on a range of specific policy provisions,” Moody’s said.

Sally makes eight named storms that have impacted the U.S. so far this year, which is the most by mid-September in the historical record, KCC said.

Was this article valuable?

Here are more articles you may enjoy.

"impact" - Google News

September 23, 2020 at 01:54PM

https://ift.tt/3kAVSEc

Insurer Impact from Sally Expected to be Moderate; Losses Estimated at $1B to $3B - Insurance Journal

"impact" - Google News

https://ift.tt/2RIFll8

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Insurer Impact from Sally Expected to be Moderate; Losses Estimated at $1B to $3B - Insurance Journal"

Post a Comment